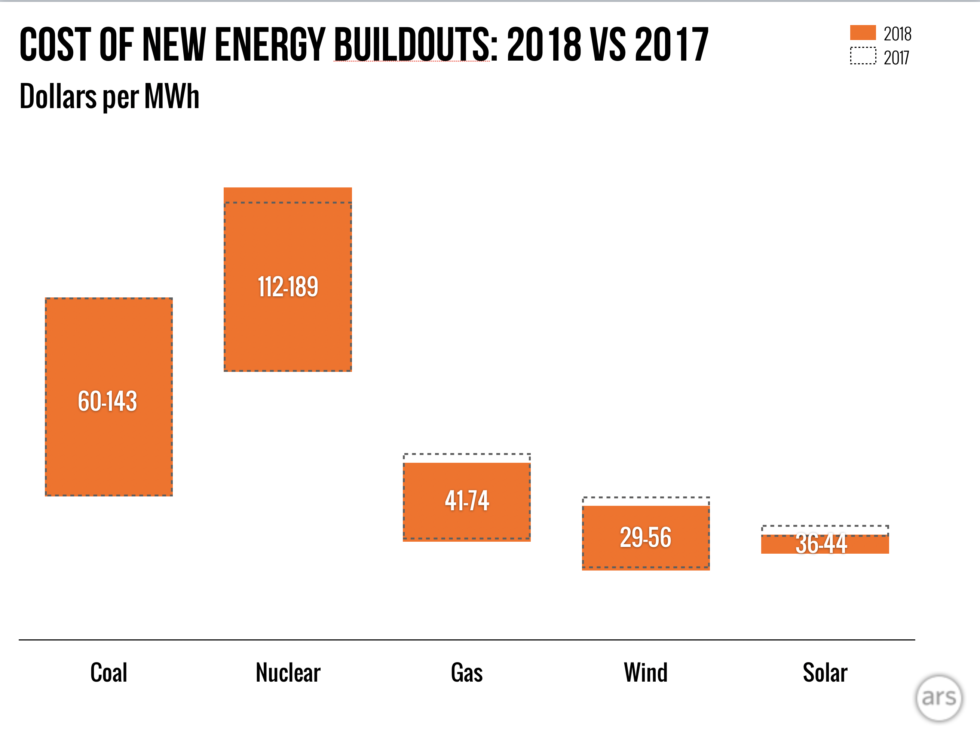

New year, same story: Cost of wind and solar fall below cost of coal and gas

It’s that time of the year again: time for asset management company Lazard to release its annual Levelized Cost of Energy (LCOE) study. (We know, you’ve been waiting all year.) The numbers in the report offer economic insight into how energy choices were made in the previous year and how the energy landscape will likely change in the coming year.

The bottom line? The cost of coal-fired electricity per megawatt-hour hasn’t budged a bit from 2017, while wind and solar costs per MWh are still falling. That spells bad news for an American coal revival, especially in places where the cost of building brand-new renewable installations is cheaper than the cost of operating existing coal and gas plants—a situation that Lazard says is happening with increasing frequency (PDF).

Lazard surveys energy buildouts that occurred in the previous year and divides the estimated cost of building and operating the plant, including fuel cost estimates, by the amount of energy a particular plant is expected to produce in its lifetime. This is useful because a nuclear power plant might cost billions to build, but it would have a vastly longer life and higher output than, say, a field of solar panels. By breaking costs down on a per-megawatt-hour basis, it becomes easier to compare sources of electricity.

Here, utility-scale solar photovoltaic stands out because unsubsidized costs to install actually fell on a per-MWh basis, despite solar tariffs instituted by the Trump administration in early 2017. Part of this may be due to the fact that China ended a domestic solar panel subsidy, causing Chinese customers to buy fewer solar panels, resulting in a glut of panels that could be sold for even cheaper on the international market than before.

A word on storage

Although this is Lazard’s 12th year quantifying the cost of energy, it’s only the fourth year that it has released a separate report quantifying the cost of storage (PDF). Energy storage includes grid-scale lithium-ion batteries as well as vanadium and zinc flow batteries, lead-acid batteries, and advanced lead batteries.

Lazard breaks these down further by market: batteries selling storage wholesale have different revenue streams than batteries connected to utility-grade solar or commercial standalone batteries that are not controlled by a utility.

Here, Lazard says that lithium-ion batteries showed significant cost declines in the relevant markets throughout 2018. Meanwhile, “cost declines for flow batteries are less significant but still observable,” Lazard writes. The asset management company unfortunately doesn’t expect that to last: “Future declines in the cost of lithium-ion technologies are expected to be mitigated by rising cobalt and lithium carbonate prices as well as delayed battery availability due to high levels of factory utilization.”

Lazard also found that shorter-duration batteries, which can discharge over about four hours, are the most cost-effective of any batteries. These batteries “improve the grid’s ability to respond to momentary or short duration fluctuations in electricity supply and demand.” This has been confirmed by reports from real-world battery use in Australia, where the massive Tesla battery at the Hornsdale Wind Farm has been used to maintain grid frequency, rather than replacing more traditional forms of electricity generation.