Crypto hedge funds struggle to recover from “bloodbath”

Volatility in cryptocurrency prices causes big losses for highly-leveraged funds. …

reader comments

111 with 76 posters participating

Vlad Matveev has learned the hard way how volatile cryptocurrency hedge funds can be.

The 50-year-old Muscovite invested $250,000 last year with California-based Cryptolab Capital, which targeted double-digit gains from trading crypto regardless of whether the market rose or fell. But Matveev said his investment fell 98.5 percent in value when the fund folded in this year’s coronavirus-induced turmoil.

“I don’t really know what happened,” said Matveev, a fund manager-turned-private investor. “They said they had a diversified set of strategies.”

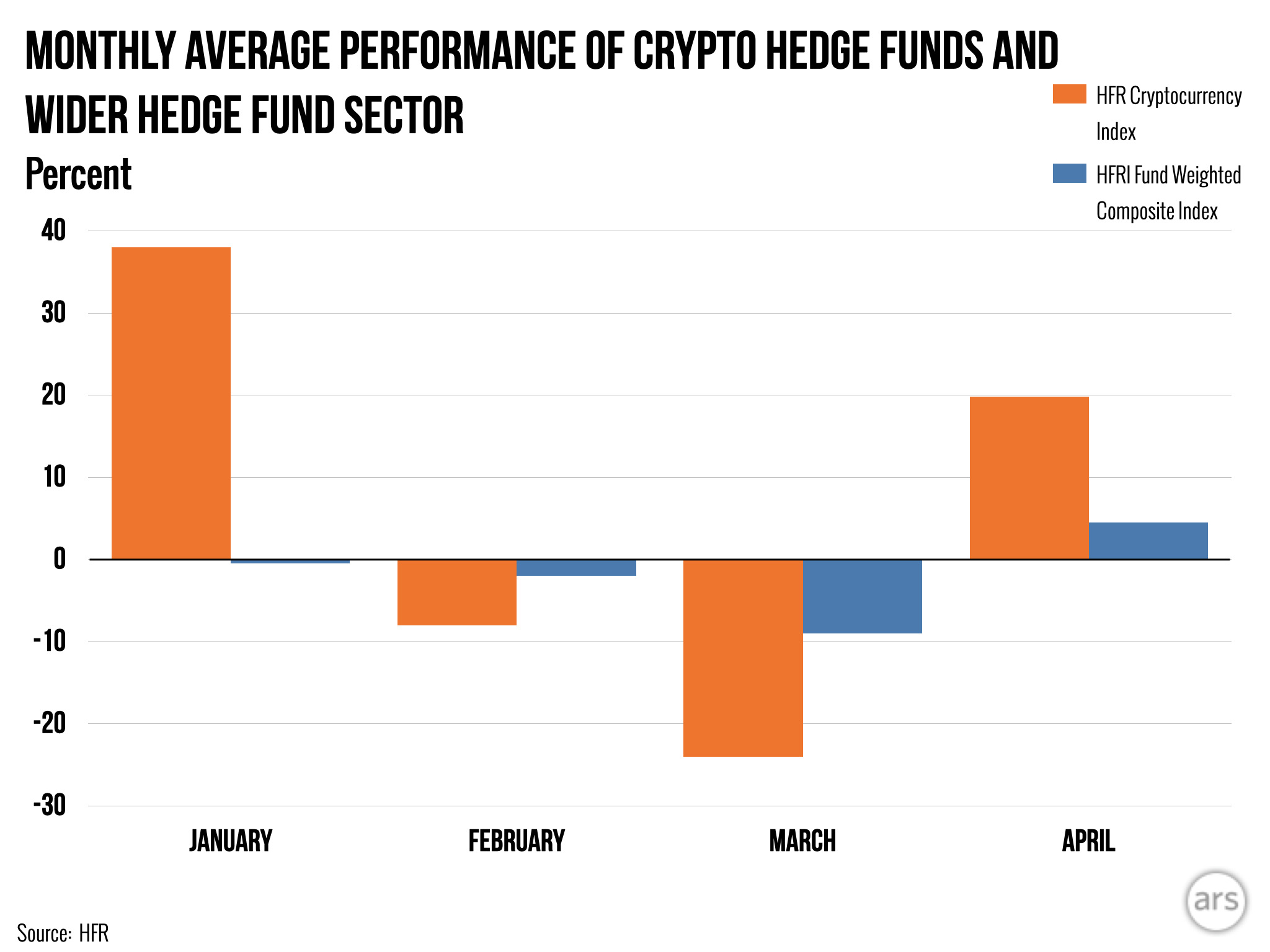

Investors have been drawn to crypto hedge funds by the promise of big returns compared with the paltry or negative yields on offer from cash or bonds. This year, bitcoin has emerged from the big March sell-off as one of the best-performing assets: up 36 percent for the year, compared with the S&P 500’s 8 percent fall.

Price discrepancies between the same assets on different exchanges, which have long been arbitraged away in stock and bond markets but still exist in crypto, also offer traders a way to make money. The total value of the crypto market comes to $265 billion, according to coinmarketcap.com.

But achieving those returns has often proved a bumpy ride for hedge fund investors. A 39 percent drop in the price of bitcoin on March 12 caught many funds by surprise, leading to large losses and some fund closures, particularly among those running high levels of risk.

“It’s an understatement to say it’s a bloodbath across the board,” said Edouard Hindi, partner at Mayfair-based hedge fund Tyr Capital. Tyr is one

Continue reading – Article source